CREATING WEALTH THROUGH HOME OWNERSHIP - THE PROOF

| Several real estate economists have shown that the average homeowner accumulates more overall wealth than the average renter.However, it is not clear how this is done. Is it that owned property usually appreciates at such a rate that, after considering leverage, returns to ownership are extraordinarily high? Said another way, might homeowners accumulate more overall wealth because ownership is a great levered equity creator through property appreciation? Or, is it that owners acquire greater wealth, on average, because they are systematically paying down a mortgage thereby creating equity thanks to loan amortization? In other words, paying off property creates wealth. |

In ongoing research being conducted by Beracha and Johnson, these and other questions concerning home ownership and the accumulation of wealth are being investigated. In earlier research, Beracha and Johnson show that renting is the superior investment strategy; however, in this earlier strict horse race between buying and renting, a very bold assumption is made. Specifically, it is assumed that any rent savings (from lower rent versus mortgage payments) are reinvested without fail. Thereby, after balancing all of the costs and benefits from ownership and comparing them to renters’ portfolios from reinvesting rent savings, renting wins.

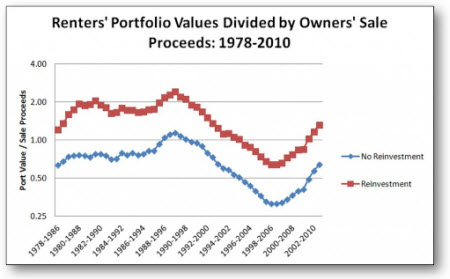

The question, however, very quickly becomes that, in a setting where Americans generally save less than 5% of their disposable income, is this assumption realistic and how might the removal of this reinvestment decision alter the outcome of the horse race between buying and renting? As part of their current research, this question is directly addressed. In particular, Beracha and Johnson find that after allowing renters to spend any rent savings on consumption (beer, cookies, healthcare, education, etc.), ownership leads to greater wealth accumulation, on average. The graph below highlights this finding.

The graph looks at the ratio of renters’ portfolio values to owners’ proceeds from sale for the entire U.S. between 1978 and 2010 both with strict reinvestment of rent savings and without reinvestment of rent savings.[iii] Clearly, numbers greater than 1 indicate that renting leads to greater wealth accumulations, while numbers less than 1 indicate that home ownership creates greater wealth, on average.

When renters are forced to reinvest (top line in the graph), the results confirm the earlier findings of Beracha and Johnson (2012). That is, in a strict horse race between buying and renting, renting wins in the vast majority of cases. However, when renters are allowed to spend rent savings on consumption (i.e. economically act like the typical American consumer), home ownership wins in virtually all instances. Notice that in the bottom line of the graph (no reinvestment), the renters’ portfolio values divided by owners’ sale proceeds is great than 1 for only four of the 32 years of the study. Thus, when renters are allowed to spend rent savings, home ownership is the clear winner in the wealth accumulation horse race.

Finally, in the same current research, Beracha and Johnson find that allowing for property appreciation rates to increase as much as 20% over their actual historic values results in virtually no change in the outcomes concerning wealth accumulation. That is, property appreciation contributes only marginally to wealth accumulation.

Implications

Without proof many have speculated about this outcome for years. However, there is now actual quantifiable evidence that home ownership is not the great levered equity creator that it has so often been touted to be. Instead, it appears that home ownership creates extra wealth mainly through its ability to force owners to save rather than through property appreciation. Thus, home ownership appears to be a self-imposed savings plan, which through time leads to greater wealth accumulation as compared to comparable renters. In short, buying a home makes Americans save.

Who says that Americans are horrible savers? Apparently, we are not. We have simply been saving through our homes rather than putting our savings in the bank.

For more info: Feel free to call me@3122645846..rgoldstein@rubloff.com

chicagoluxuryrealty.com

3 comments:

Interesting blog! thank you for taking time to discus this and sharing this to us, your blog is has useful information, and this also help for those who are interested on real estate.

purchase property in us

Buying a house is a great goal for the New Year. Make sure that resolution has some back up with a life insurance policy. You can get a quick and easy quote from IntelliQuote in just minutes. Find out how little it could cost to keep (and protect) that home for future generations. http://bit.ly/zdweX8

A house owner will pay interest on his home loan and regional residence taxation on his home, while a person who leases an house will pay lease.

Lake Norman HOA Management

Post a Comment