By

John Riha

Article from

HouseLogic.com

Is beauty in the eye of the beholder? These 8 ugly houses answer that

age-old question with a resounding: Yes! Despite some odd proportions,

strange building materials, and off-the-wall colors, these prideful

homes all have redeeming qualities that endear them to their owners. For

one, they’re all unique. And in this cookie-cutter world, that’s saying

a whole lot! Which is your favorite?

Credit: JSome1, photographer

A House that Rocks

Credit: JSome1, photographer

A House that Rocks

If you’re looking for a rock-solid investment, how about this house in

Portugal? Situated between two giant boulders, the house walls are

formed of mortared masonry, and the living area is covered by concrete

tile

roofing. Fireproof, windproof, and impervious to insects, a house like this might qualify you for lower

home owners insurance rates.

It’s a Bird! It’s a Plane! It’s My Home!

It’s a Bird! It’s a Plane! It’s My Home!

Insect-proof, fireproof, and able to withstand 575 mph winds, this

Boeing 727 features more than 1,000 square feet of living area, and

there are plenty of

storage solutions

in the cargo hold and in the overhead compartments. The jet body cost

about $100,000 (without engines). Moving the decommissioned jet to its

final resting place and outfitting it for living cost another $100,000.

Credit: From www.AirplaneHome.com, republished with permission

Make Homes, Not War!

Make Homes, Not War!

Can your home survive a direct nuclear strike? This one can. Made from a

decommissioned missile silo in upstate New York, it’s one of the

strongest structures ever built. The 2,300-sq.-ft., below-ground portion

includes a full kitchen, entertainment center, and two private suites.

Entrance is gained via an 1,800-sq.-ft. log home on the surface, and

there’s a private runway. Buy-in price? About $750,000.

Credit: ColdWarMissileSilo.com

Horton Hears a House

Horton Hears a House

Choosing the right colors for your

exterior paint job

is critical to preserving your home’s value, unless you happen to think

like Dr. Seuss, in which case just about anything goes. This bright and

fantastical house is located in (where else?) North Pole, Alaska, where

a bit of colorful whimsy is a welcome sight.

Credit: Peggy Asbury

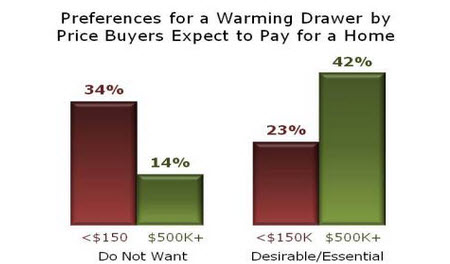

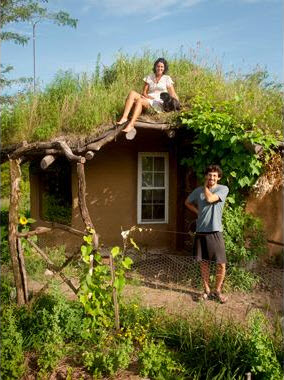

A Mud Home That’s Dirt Cheap

A Mud Home That’s Dirt Cheap

With its

green roof

and rural flavor, this 200-square-foot cottage in Missouri has its, um,

roots in the centuries-old art of cob construction—earthen walls formed

of clay, sand, and straw. Cost of construction was about $4,000, or a

modest $20 per square foot. Of course it includes a mudroom addition.

Credit: Brian “Ziggy” Liloia and April Morales / photograph by Stephen Shapiro

A House Out Standing in its Field

A House Out Standing in its Field

With its multiple balconies, twisting staircases, and oddly shaped

rooms, this whimsical house in Wyoming is a local curiosity. Although

it’s no longer occupied, the original owner/builder used locally

harvested logs and plenty of

salvaged building materials to produce a one-of-the-kind cowboy mansion that towers above the plains.

Credit: Robert Elzey

People in Glass Houses...

People in Glass Houses...

These home owners are obviously into self-reflection. Clad in pieces of

glass and mirror, this enlightened folk art cottage in Florida requires a

lot of

window cleaning. For a more maintenance-free exterior, try

vinyl or fiber-cement siding.

Credit: Gordon Borman

This House is a Real Steel

This House is a Real Steel

Think twice before you bang your head against the walls of this

Gainsville, Fla., house. Built from salvaged steel shipping containers

($2,500-$5,000 each), this 2,200-square-foot flight of fancy features

three bedrooms and two and a half baths. It’s fireproof, sustainable

(repurposed materials!), and you sure won’t have to worry about

termites.

John Riha has written seven books on home improvement

and hundreds of articles on home-related topics. He’s been a

residential builder, the editorial director of the Black & Decker

Home Improvement Library, and the executive editor of Better Homes and

Gardens magazine. The

cost of a home is determined mainly by two components: price and

mortgage rate. Today, we want to show how the monthly cost of purchasing

a median priced home has changed over the last twelve months and how it

might change over the next twelve months. For the first two examples,

we will be using the National Association of Realtors’ (NAR) Existing Home Sales Report to establish median price and Freddie Mac’s Primary Mortgage Market Survey to establish mortgage rate. We also assumed a 20% down payment in all examples.

The

cost of a home is determined mainly by two components: price and

mortgage rate. Today, we want to show how the monthly cost of purchasing

a median priced home has changed over the last twelve months and how it

might change over the next twelve months. For the first two examples,

we will be using the National Association of Realtors’ (NAR) Existing Home Sales Report to establish median price and Freddie Mac’s Primary Mortgage Market Survey to establish mortgage rate. We also assumed a 20% down payment in all examples.