Friday, July 31, 2015

Thursday, July 30, 2015

Are Home Values REALLY at Record Levels?

Are Home Values REALLY at Record Levels?

Last week, the National Association of Realtors (NAR) released their Existing Home Sales Report. The report announced that the median existing-home price in June was $236,400. That value surpasses the peak median sales price set in July 2006 ($230,400). This revelation created many headlines exclaiming that home prices had hit a “new record”:

Wall Street Journal: Existing-Home Prices Hit Record

USA Today: Existing home sales surge, prices hit record

Though the headlines are accurate, we want to take a closer look at the story. We do not want people to believe that this information is evidence that a new “price bubble” is forming in housing.NAR reports the median home price. That means that 50% of the homes sold above that number and 50% sold below that number. With fewer distressed properties (lower valued) now selling, the median price will rise. The median value does not reflect that each individual property is increasing in value.

Below are the comments from Bill McBride, the author of the esteemed economic blog Calculated Risk. McBride talks about the challenges with using the median price and also explains that in “real” prices (taking into consideration inflation) we are nowhere close to a record.

“In general I'd ignore the median sales price because it is impacted by the mix of homes sold (more useful are the repeat sales indexes like Case-Shiller or CoreLogic). NAR reported the median sales price was $236,400 in June, above the median peak of $230,400 in July 2006. That is 9 years ago, so in real terms, median prices are close to 20% below the previous peak. Not close.”Earlier this week, the Wall Street Journal covered this issue in detail. In this story, Nick Timiraos explained that this rise in median prices is nothing to be concerned about:

“Does this mean we have another problem on our hands? Not really…There may be other reasons to worry about housing affordability by comparing prices with incomes or prices with rents for a given market. But crude comparisons of nominal home prices with their 2006 and 2007 levels shouldn’t be used to make cavalier claims about a new bubble.”

Bottom Line

Home values are appreciating. However, they are not increasing at a rate that we should have fears of a new housing bubble around the corner.by The KCM Crew

--

Ron Goldstein,MBA

Certified Luxury Broker@Berkshire Hathaway Chicago & St. Petersburg

chicagoluxuryrealty.com stpeteluxuryrealty.com

(o)312-264-5846 (c)312-771-7190 (f)312-264-5746

Offices in Chicago and St. Petersburg

2014 BHHS President's Circle - Top 4% in Nation

Tuesday, July 28, 2015

Buyer Demand Continues To Outpace Housing Supply

The price of any item is determined by the supply of that item, and the market demand. The National Association of Realtors (NAR) recently released their latest Existing Home Sales Report.

Inventory Levels & Demand

Sales of existing homes rose 3.2% from May, outpacing year-over-year figures for the ninth consecutive month. Total unsold housing inventory is at a 5.0-month supply.This is down from May’s 5.1-month supply and remains below the 6 months that is needed for a historically normal market.

Consumer confidence is at the highest level in over a decade. Pair that with interest rates still around 4%, new programs available for down payments as low as 3%, and you have an attractive market for buyers.

Buyer demand for housing surged to it’s highest level since June 2013.

Prices Rising

June marked the 40th consecutive month of year-over-year price gains as the median price of existing homes sold rose to $236,400 (up 6.5% from 2014).So What Does This Mean?

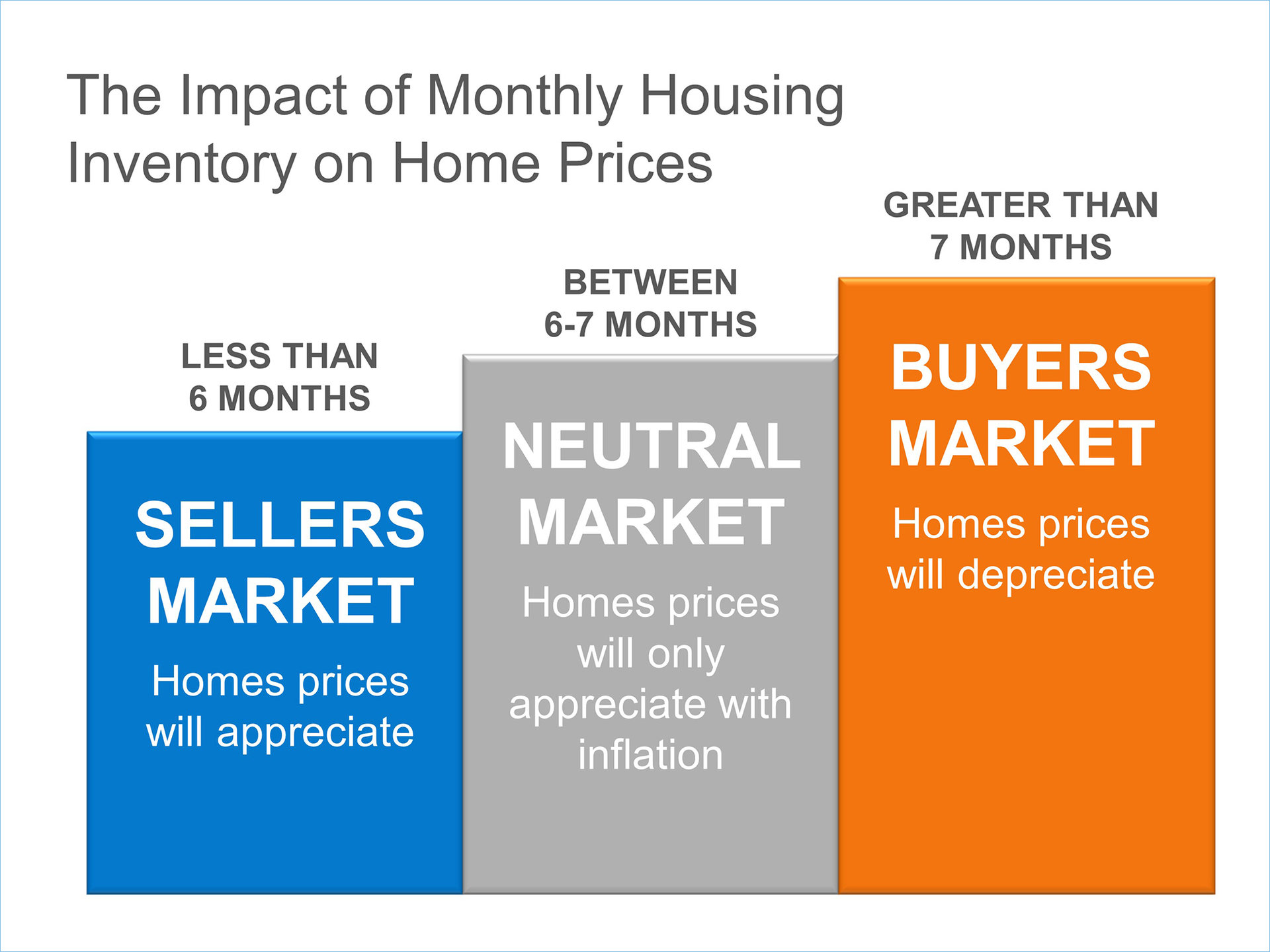

The chart below shows the impact that inventory levels have on home prices.

NAR’s Chief Economist, Lawrence Yun gave some insight into the correlation:

"Limited inventory amidst strong demand continues to push home prices higher, leading to declining affordability for prospective buyers."NAR’s President, Chris Polychron added:

"The demand for buying has really heated up this summer, leading to multiple bidders and homes selling at or above asking price."

Bottom Line

If you are debating putting your home on the market in 2015, now may be the time. The number of buyers ready and willing to make a purchase is at the highest level in years. Contact a local professional in your area to get the process started.by The KCM Crew on July 28, 2015

Monday, July 27, 2015

5 Reasons why now is a Fantastic Time to Sell!

Posted: 27 Jul 2015 04:00 AM PDT

As the temperature continues to rise, buyers are coming out ready to

purchase their dream home. Here are five reasons that you should list

your house for sale now.

As the temperature continues to rise, buyers are coming out ready to

purchase their dream home. Here are five reasons that you should list

your house for sale now.

1. Strong Buyer Demand

Foot traffic refers to the number of people out actually physically looking at homes right now. The latest foot traffic numbers show that there are significantly more prospective purchasers currently looking at homes than at any point in the last two years! These buyers are ready, willing and able to purchase… and are in the market right now! Take advantage of the buyer activity currently in the market.2. There Is Less Competition Now

The National Association of Realtors reported last week that housing supply as slipped to a 5.0-month supply. This is still under the 6-month supply that is needed for a normal housing market. This means, in most areas, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices. There is a pent-up desire for many homeowners to move as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as real estate values have increased over the last two years. Many of these homes will be coming to the market in the near future. The choices buyers have will continue to increase. Don’t wait until all this other inventory of homes comes to market before you sell.3. Home Prices Are Skyrocketing

Daren Blomquist, President of RealtyTrac, recently shared insights into why “2015 is a Great Year to Sell” by saying:"So far in 2015, [sellers] are realizing the biggest gains in home price appreciation since 2007. In June, sellers sold for above estimated market value on average for the first time in nearly two years."One major factor driving prices up is the lack of inventory available for the amount of buyers in the market. Often buyers, who find a home that they would like to make an offer on, are met with the reality that they aren’t the only ones interested.

4. There Will Never Be a Better Time to Move-Up

If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by over 19.4% from now to 2019. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30-year housing expense with an interest rate near 4% right now. Rates are projected to increase by a full percentage point over the next year according to Freddie Mac.5. It’s Time to Move On with Your Life

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? Only you know the answers to the questions above. You have the power to take back control of the situation by putting your home on the market. Perhaps, the time has come for you and your family to move on and start living the life you desire.That is what is truly important.

-

Ron Goldstein,MBA

Certified Luxury Broker@Berkshire Hathaway Chicago & St. Petersburg

chicagoluxuryrealty.com stpeteluxuryrealty.com

(o)312-264-5846 (c)312-771-7190 (f)312-264-5746

Offices in Chicago and St. Petersburg

2014 BHHS President's Circle - Top 4% in Nation

Friday, July 24, 2015

St. Pete to Sarasota.Luxury Redefined!

Ron Goldstein,MBA

Certified Luxury Broker@Berkshire Hathaway Chicago & St. Petersburg

chicagoluxuryrealty.com stpeteluxuryrealty.com

(o)312-264-5846 (c)312-771-7190 (f)312-264-5746

Offices in Chicago and St. Petersburg

2014 BHHS President's Circle - Top 4% in Nation

Thursday, July 23, 2015

Carpe diem - This is living!

Enjoy your morning coffee on your private 24 ft. deck over looking the

lake in this boutique mid-rise in the heart of Lincoln Pk. Walk across

the st. to Green City Mkt then bring your fresh bounty back to this

remodeled 1400SF home. Invite your friends to your air & water show

soiree - front & center! Great closet & storage space. Steps to

the lake & adj. to all public transportation! Carpe diem - This is

living!

1920 N. Clark 2/2.$409,800

Check out the virtual tour @

http://tours56.vht.com/RRI/T433328350

1920 N. Clark 2/2.$409,800

Check out the virtual tour @

http://tours56.vht.com/RRI/T433328350

Monday, July 6, 2015

St. Pete to Sarasota. Your waterfront lifestyle awaits.

Very pleased to introduce our newest lifestyle video from St. Pete to

Sarasota. Your waterfront lifestyle awaits. Check it out and let me know

your thoughts. Thx!

Thursday, July 2, 2015

Colleagues/Friends-Expanding my Berkshire Hathaway teams in Chicago area and Tampa/St. Pete/Sarasota areas.

Colleagues/Friends-Expanding my Berkshire Hathaway teams in Chicago area

and Tampa/St. Pete/Sarasota areas. Looking for newly licensed and/ or

seasoned A+ -eager entrepreneurs to grow and learn and experience the

dynamic real estate boom in These great cities!

Please email me@rgoldstein@koenigrubloff.com for more info

Chicagoluxuryrealty.com

Stpeteluxuryrealty.com

Luxury Redefined!

# soldonkoenigrubloff

# chicagoluxuryrealty.com

#stpeteluxuryrealty.com

#tampabayfloridaluxuryrealty.com

#sarasotafloridaluxuryrealty.com

Please email me@rgoldstein@koenigrubloff.com for more info

Chicagoluxuryrealty.com

Stpeteluxuryrealty.com

Luxury Redefined!

# soldonkoenigrubloff

# chicagoluxuryrealty.com

#stpeteluxuryrealty.com

#tampabayfloridaluxuryrealty.com

#sarasotafloridaluxuryrealty.com

Subscribe to:

Posts (Atom)